Livongo’s growing member base can be used as a platform for a broad range of health services in the future.

The high return on investment for clients is likely to drive widespread adoption, particularly as these types of services gain increased acceptance.

The company is well-positioned to succeed, provided that it can continue to increase enrollment amongst client employees and reduce member churn.

Livongo (LVGO) is a digital health services vendor which provides clients with solutions that enable members with chronic health conditions to better manage their condition. While Livongo’s services are relatively simple, they drive better health outcomes for patients and reduce healthcare costs for clients, making it likely that these types of services will become widely adopted in the long run. The share price has more than doubled in recent months and the company’s EV/S ratio is relatively high, but I believe the stock is still attractive due to Livongo’s large market opportunity.

Market

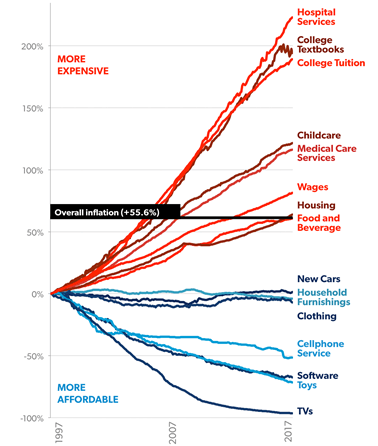

Healthcare costs are a large and growing burden in developed countries, driven by high inflation in healthcare costs along with lifestyle factors (diet and exercise) and aging populations. Over the past five years, the average annual deductible among all covered employees rose by 53% to $1,350, which is not sustainable in the long run.

Figure 1: U.S. Inflation by Category 1997-2017

(Source: MarketWatch)

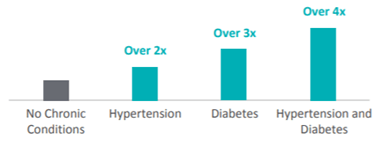

In 2014, approximately 60% of U.S. adults had one or more chronic conditions and over 40% had two or more chronic conditions, with chronic and behavioral health conditions accounting for 90% of healthcare spending. Chronic conditions include diabetes, hypertension, obesity and depression.

Figure 2: Relative Cost of Chronic Conditions

(Source: Livongo)

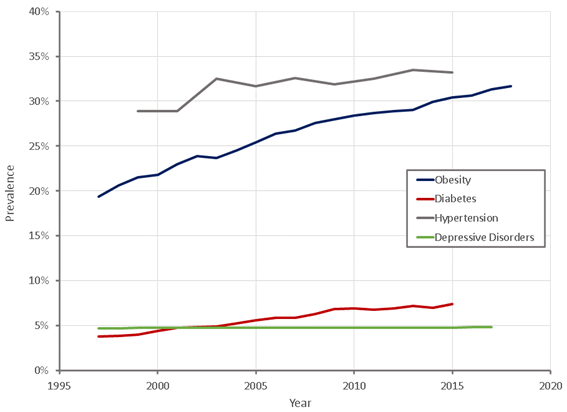

A 2018 Milken Institute study indicated chronic conditions collectively cost the U.S. economy approximately $1.1 trillion in direct healthcare costs and an additional $2.6 trillion from lost productivity. Diabetes is a growing problem in the U.S. which currently affects over 7% of adults and costs the healthcare system in excess of $237 billion in 2017, with an additional $90 billion lost due to reduced productivity. In addition, 27% of U.S. adults have prediabetes, putting them at elevated risk of developing diabetes if their health is not better managed.

Figure 3: Prevalence of Chronic Conditions in the U.S.

(Source: Created by author using data from Statista, CDC, CDC, OurWorldInData.org)

The current healthcare system was not designed to manage people with chronic conditions on a continuous basis, which means people are left to manage their condition with little guidance. Innovative solutions which result in better health outcomes for patients and lower costs are required and digital solutions are likely to play a large part in a similar manner to other fields. Digital health tools aim to increase engagement, collaboration (amongst users, clinicians, coaches, etc.) and drive behavioral change, which in turn should lead to improved health outcomes.

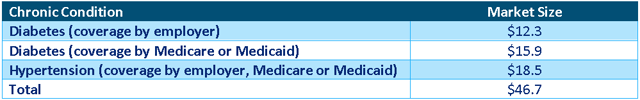

Based on estimates of the number of people in the U.S. with healthcare coverage, the prevalence of chronic conditions and Livongo’s average solution cost, the company has estimated a total addressable market of $46.7 billion.

Table 1: Livongo’s Addressable Market

(Source: Created by author using data from Livongo)

Livongo

Livongo offers a consumer-focused health platform which aims to improve health outcomes for people with chronic health conditions using:

- Connected devices

- Data-driven insights

- Personalized digital guidance

- Access to health professionals

Livongo first offered a solution for diabetes and has since added prediabetes, weight management, hypertension and behavioral health through a combination of internal development and acquisitions.

- Livongo for Diabetes: Service to help members manage diabetes using a connected blood glucose meter, blood glucose test strips, personalized advice to encourage behavior change, digital tools, as well as coaching and monitoring.

- Livongo for Hypertension: Service to help members manage hypertension using a connected blood pressure monitor, personalized advice to encourage behavior change, digital tools, as well as coaching and monitoring.

- Livongo for Prediabetes and Weight Management: Service to help members manage prediabetes and weight using a connected weight scale, health education content, personalized coaching by dietitians and physiologists, and online communities to encourage healthy behaviors.

- Livongo for Behavioral Health by myStrength: Service to help members resolve clinical conditions and improve mental health using evidence-based interventions.

To gain widespread adoption, Livongo must save clients’ money, improve health outcomes for members and deliver an experience which continues to engage members in the long run. The company has collected a significant amount of data showing tangible health improvements for members across all of its services.

Figure 4: Livongo Member Health Outcomes

(Source: Livongo)

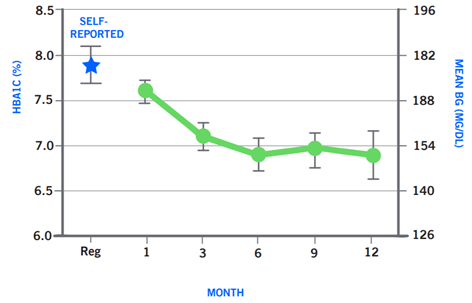

Figure 5: Livongo’s Effect on HbA1c for Jefferson Health – Northeast Employees

(Source: Livongo)

While Livongo’s services are relatively basic and the health outcomes may appear modest, they have a significant flow-through impact on health. A 10 mmHg reduction in systolic blood pressure has been shown to reduce stroke rates by 41% and is comparable to starting a blood pressure medication. A 1% reduction in HbA1c can:

- Reduce death from diabetes by 21%

- Reduce heart attacks by 14%

- Reduce peripheral vascular disease by 43%

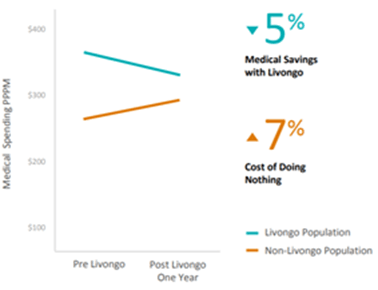

The ability of Livongo to affect positive behavior changes by members which help to reduce subsequent health problems creates overall healthcare cost reductions for clients. After implementing Livongo, Jefferson Health saw a 17% reduction in diabetes-related medical spend, an 11% reduction in all medical claims, a 21% reduction in emergency room visits and a 7.8% reduction in hospital admission rates. Livongo for Diabetes can save clients approximately $1,200 per member annually based on a difference-in-difference cohort analysis, which results in a return on investment of approximately 40% after 1 year. These are compelling cost outcomes for companies which may be struggling to manage healthcare costs, and if this is sustainable and holds across chronic conditions, it points to high adoption rates long term. For clients, purchasing is not just about weighing the potential health benefits for users, it is a straightforward cost reduction initiative with high return on investment.

Figure 6: Livongo’s Effect on Medical Spending

(Source: Livongo)

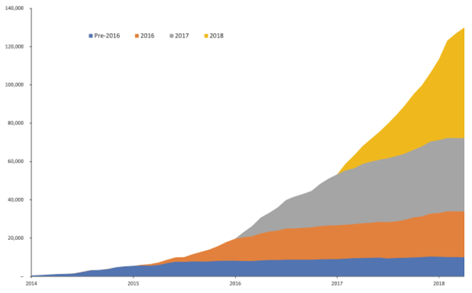

The most concerning metrics for Livongo are member enrollment and engagement, which appear to be somewhat low. Livongo for Diabetes clients who launched enrollment in 2018 only had 34% of total recruitable individuals signed up after 12 months.

Figure 7: Diabetes Members by Annual Customer Cohort

(Source: Livongo)

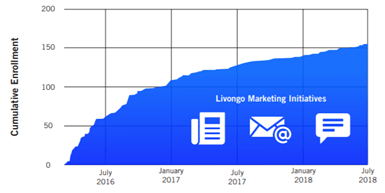

Jefferson Health has achieved a 49% enrollment rate amongst eligible employees with a 90% activation rate after several years. The majority of member enrollment occurs within the first 6-12 months of launching services, and it appears Livongo will have difficulty achieving enrollment above 50% in the foreseeable future with most clients.

Figure 8: Jefferson Health – Northeast Enrollment

(Source: Livongo)

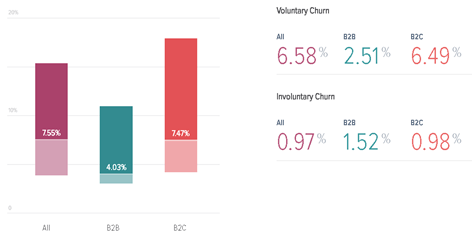

In addition to modest levels of enrollment, monthly member churn is 2%, which implies a 78.5% retention rate over 12 months. This figure is concerning, as it indicates the service is not particularly sticky for members. Livongo’s member churn actually compares favorably to most subscription healthcare companies though, particularly B2C companies. While member churn is high, there is likely a core group of members who derive value from the service and will continue to use it long term. For example, amongst Iron Mountain (IRM) employees who were Livongo members, 74% felt better about managing their diabetes and 75% wanted to keep using Livongo.

Figure 9: Typical Monthly Churn for Subscription Healthcare Companies

(Source: Recurly)

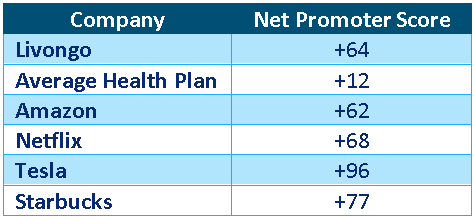

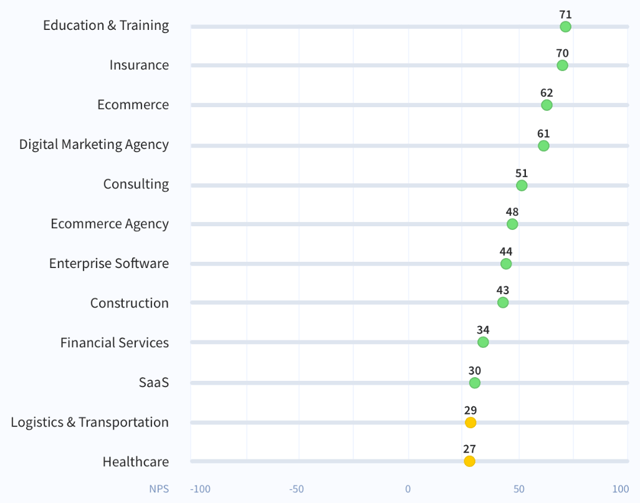

Livongo’s member net promoter score is quite high though, particularly for a healthcare company, and is comparable to other leading consumer brands. These figures may indicate that only a modest subset of the total population has an appetite for this type of service, but amongst those that are willing to consistently engage with Livongo’s services, satisfaction is extremely high.

Table 2: Livongo Member Net Promoter Score

(Source: Created by author using data from Livongo and Retently)

Figure 10: Typical Net Promoter Score Across Industries

(Source: Retently)

Livongo utilizes a combination of direct sales and channel partners like Express Scripts, CVS Pharmacy (CVS), Health Care Service Corporation, Anthem (ANTM) and Highmark. The top five channel partners accounted for 50% of Livongo’s revenue in 2018, which presents a concentration risk, although this has allowed Livongo to scale its business rapidly.

Livongo’s clients are employers, health plans, government entities and labor unions, and revenue is mainly from sales to clients that are self-insured employers. 20% of the Fortune 500 are Livongo clients, and the company’s top ten clients by enrollment accounted for 16% of total revenue for the quarter ended March 31, 2019. Client satisfaction appears relatively high, as Livongo’s client retention rate is 95.9% annually.

It is difficult to say exactly where Livongo’s competitive advantage lies given the company offers a service which should be relatively easy to replicate. Competitive advantage is likely to be a result of a combination of data volume driving improved insights, economies of scale and client relationships. Livongo aggregates data from a variety of sources, including devices, third-party applications, medical claims, pharmacy claims, member preference surveys and third-party partners. The larger and more varied the body of data Livongo is able to collect, the more the company can improve its services and the more difficult its services will be to replicate.

Livongo has a number of potential growth avenues, and in the short term is pursuing Medicare Advantage, Managed Medicare, Fee for Service Medicare, Medicaid and other fully insured employers. Livongo has a range of initiatives that are aimed at accelerating and/or increasing enrollment amongst existing clients. The company is also continuing to invest in expanding its solutions and developing new solutions that address other chronic conditions. Long term, Livongo has the potential to become a full-service health platform helping members to manage health conditions and improve their overall well-being.

Financial Analysis

Livongo’s revenue is a mixture of upfront fees for devices and monthly subscriptions, with diabetes subscriptions accounting for approximately 90% of revenue in March 2019. Subscriptions typically have a term of 1-3 years, with clients being invoiced monthly on a per-member or per-solution basis, depending on the solution.

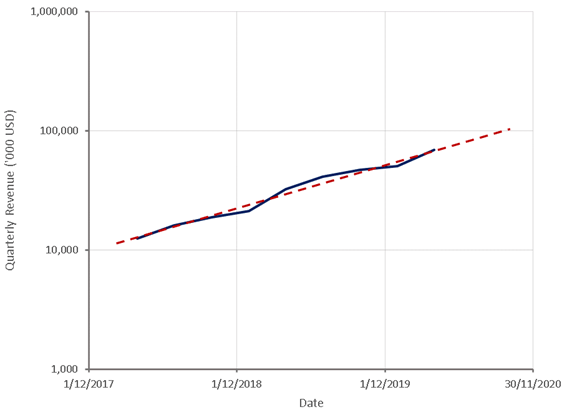

Figure 11: Livongo Revenue

(Source: Created by author using data from Livongo)

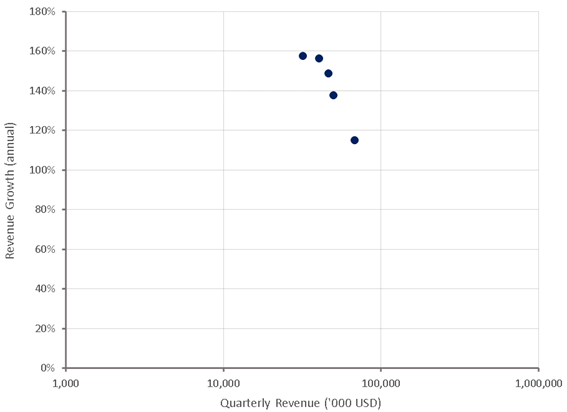

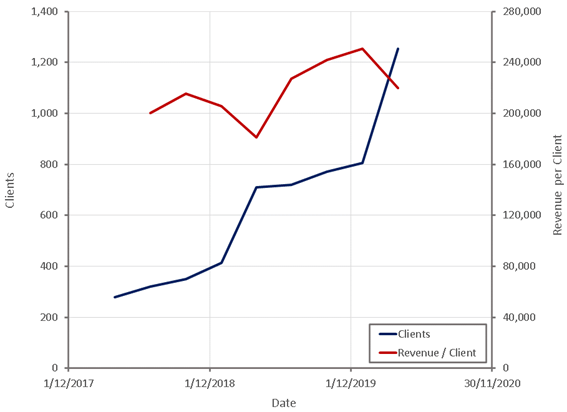

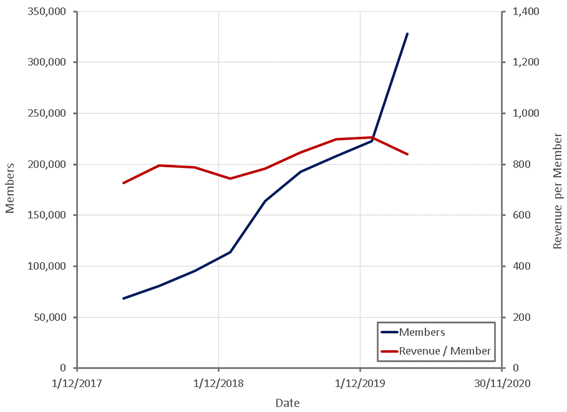

Livongo’s sales involve both client acquisition and member acquisition. The ability to target clients with a large number of employees has enabled the company to scale its business rapidly, as has the low-touch member acquisition, onboarding and retention process. Growth is driven primarily by client numbers, as Livongo’s dollar-based net expansion rate is a modest 113.8%. This is currently the result of increased enrollment over time, but there is the potential to increase the net expansion rate in the future through cross-selling, which should also enhance the member experience and improve clinical outcomes.

Figure 12: Livongo Revenue Growth

(Source: Created by author using data from Livongo)

Figure 13: Livongo Clients

(Source: Created by author using data from Livongo)

Figure 14: Livongo Members

(Source: Created by author using data from Livongo)

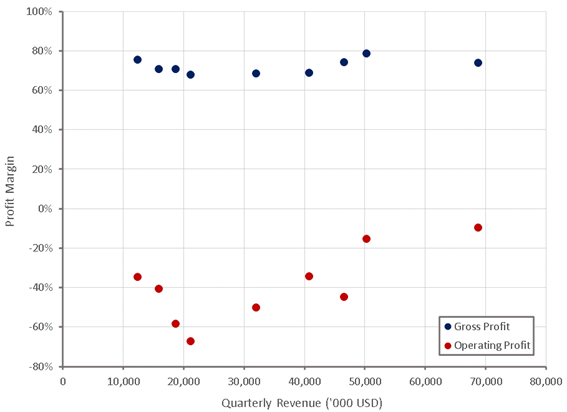

Livongo’s gross profit margins have been relatively stable over time, and operating profit margins are steadily increasing as a result of operating leverage. As the company introduces and expands additional services, there is potential for downward pressure on gross profit margins, as alternative services like weight management are likely to have lower prices than diabetes management. Livongo is likely to reach operating profitability in the next 1-2 years as the business continues to scale, dependent on how aggressively the company continues to invest in research & development and sales & marketing.

Figure 15: Livongo Profit Margins

(Source: Created by author using data from Livongo)

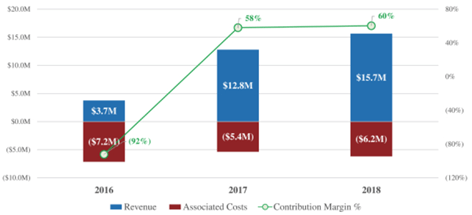

Long term, Livongo is likely to achieve a high operating profit margin as a result of its high gross margin, provided that competition does not increase significantly. This is supported by the company’s cohort contribution margin analysis that shows that the client contribution margin is high after the first year. The contribution margin is basically the gross profit minus sales and marketing expenses divided by revenue and excludes non-cash charges.

Figure 16: 2016 Cohort Contribution Margin

(Source: Livongo)

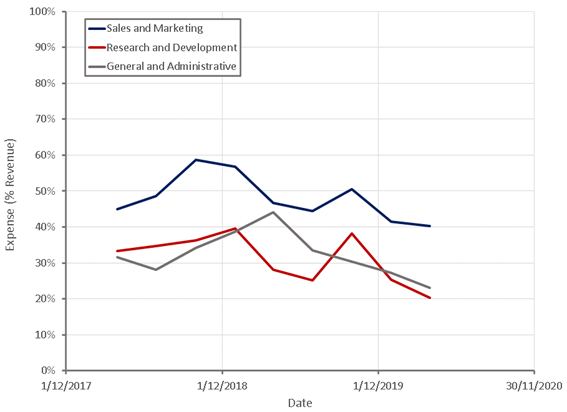

Figure 17: Livongo Overhead Expenses

(Source: Created by author using data from Livongo)

Competitors

Livongo groups its competitors into:

- Private companies offering point solutions for a single chronic condition.

- Large enterprises who are focused on the healthcare industry.

- Digital health device manufacturers who facilitate the collection of data but provide limited feedback.

Some of the key bases for competition in the market include health outcomes for members, user experience, price, brand, client relationships and sales capabilities. Livongo believes it compare favorably with its competitors across these factors, although some competitors appear to have similar solutions and / or capabilities.

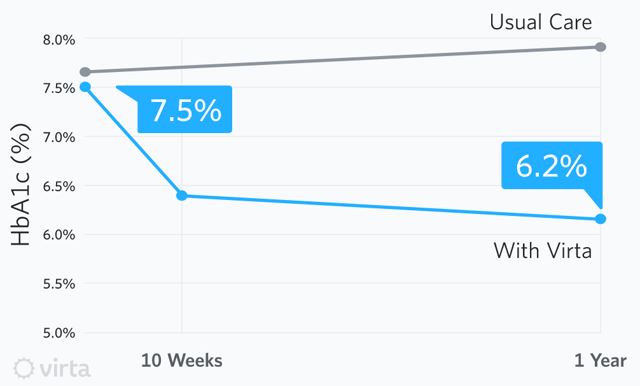

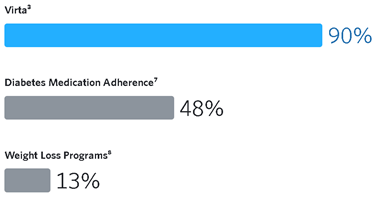

Virta Health Corp.

Virta Health Corp. offers a digital diabetes management service which appears to be focused on ketogenic diets. The company’s data shows similar health outcomes for members and significantly better member retention than Livongo. It is also willing to place 100% of fees at risk for its enterprise partners, based on health outcomes for members. Virta Health appears to have a strong point solution but is significantly smaller than Livongo and may be at a disadvantage to companies taking a broader approach to managing health.

Figure 18: Virta Health Member HbA1c Levels

(Source: Virta Health)

Figure 19: Virta Health Member Retention After 1 Year

(Source: Virta Health)

Omada Health

Omada Health is one of Livongo’s strongest competitors, as it is a similar size and offers digital care programs for type 2 diabetes, hypertension and behavioral health. Omada Health has placed an emphasis on obtaining clinical data to support the efficacy of its solutions. There are 11 peer-reviewed studies of Omada Health’s services, and in 2019, the company launched the largest-ever randomized controlled trial of digital diabetes prevention. Omada works with 600 employers and health plans and utilizes performance fees based on how much weight employees lose. At the company’s last funding round in 2019, it was valued at $600 million.

Glooko

Glooko offers an app which syncs with existing diabetes devices and stores data so that patterns can be seen and data can be shared with healthcare providers. It only offers a diabetes management solution, and its service appears to be more basic than Livongo’s and is offered at a lower price point. The company has separate services for enterprises, research facilities and individuals, with services for individuals being offered for free.

Hello Heart

Hello Heart offers a wellness program that helps reduce healthcare costs by managing heart health. It also has a hypertension solution which is in direct competition with Livongo. Similar to Livongo, 45% of Hello Heart’s target population are generally enrolled in the service within the first year. On average, members achieve a 22 mmHg average blood pressure reduction, indicating the company’s hypertension solution is superior to Livongo’s. Member satisfaction appears similar to Livongo, as Hello Heart has a member net promoter score of +61.

Figure 20: Hello Heart Effect on Medical Spending

(Source: Hello Heart)

Lyra Health

Lyra Health offers mental healthcare for employees of its clients. Enrollment from its target population is generally quite low, with only 15% employees signing up for care. This may be indicative of low demand for digital mental health solutions, which would not bode well for Livongo’s behavioral health solution. Lyra Health’s efficacy is high, with 83% of members improving, which compares favorably to Livongo’s 55% clinical improvement rate for behavioral health. It is not clear how comparable these figures are though, given the precise conditions being treated are unknown, the amount of improvement is unknown and the method of quantifying improvement in each case is unknown.

Onduo

Onduo is a virtual diabetes clinic that helps members lower HbA1c levels and learn how to manage their diabetes better. Onduo’s diabetes management solution appears to be similar to Livongo’s, although it is only a point solution and the company is significantly smaller than Livongo.

Ginger.io

Ginger.io is another digital mental health support service. 70% of its members show clinically significant improvements in symptoms of depression after 10-14 weeks of care, which compares favorably to Livongo’s behavioral health solution.

BioTelemetry

BioTelemetry (BEAT) is a remote medical technology company which offers solutions for remote cardiac monitoring, centralized core laboratory services for clinical trials, remote blood glucose monitoring and manufacturing for healthcare and clinical research customers. BioTelemetry’s cardiac monitoring solution is utilized by over 1 million patients per year to identify cardiac arrhythmias or heart rhythm disorders and to monitor the functionality of implantable cardiac devices. BioTelemetry is not a direct competitor to Livongo, but it operates in an adjacent vertical which Livongo may eventually target. It is currently a larger company than Livongo but is growing slowly and has relatively low investment in sales & marketing and research & development.

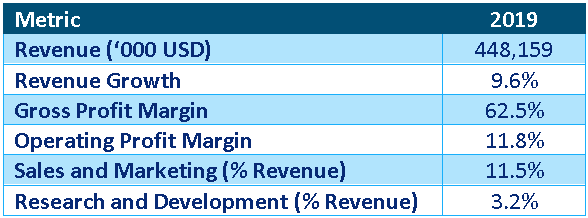

Table 3: BioTelemetry Financial Performance

(Source: Created by author using data from BioTelemetry)

Big Tech

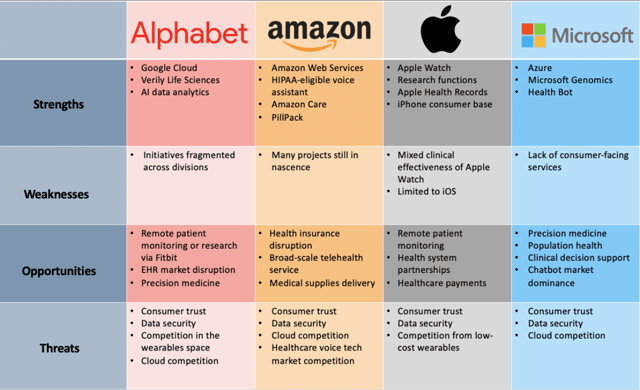

Companies like Google (GOOG), Amazon (AMZN), Apple (AAPL) and Microsoft (MSFT) are becoming increasingly interested in the healthcare space as they search for new growth opportunities. None of these companies are currently direct competitors to Livongo, but it is possible they will launch competing services in the future. It is also possible that Livongo could be an attractive acquisition target for at least one of them.

Figure 21: Big Tech SWOT Analysis

(Source: Business Insider)

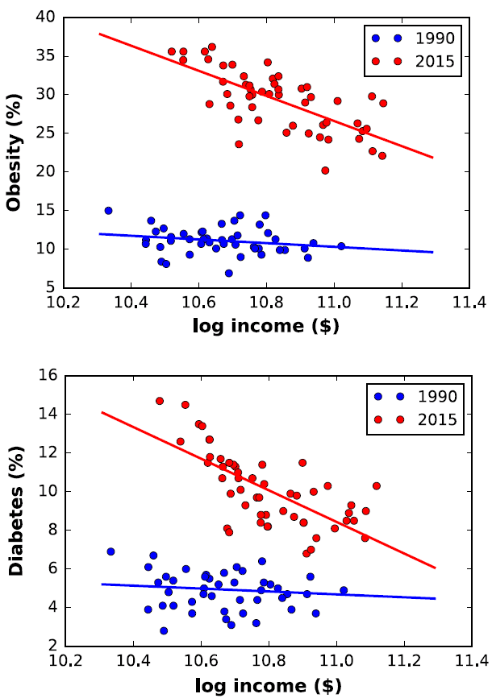

Apple is likely to utilize the Apple watch as a platform for health solutions in the future, which could enable the company to launch services which compete with Livongo. Apple’s large user base, hardware expertise and reputation as a privacy-focused business place it in a potentially strong competitive position. It is worth noting that Apple’s user base is biased towards higher-income individuals who are less likely to suffer from the health conditions Livongo is targeting though. The median iPhone user has an income of $85,000 per year, which is 40% higher than the median Android user. Conditions like obesity, hypertension and diabetes have become highly correlated with income in recent years, with low-income individuals much more likely to suffer from these conditions.

Figure 22: Relationship Between Income and Obesity / Diabetes

(Source: ConscienHealth)

Valuation

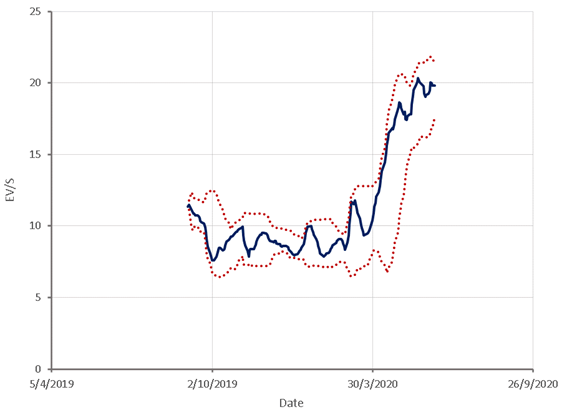

Livongo share price has increased significantly in recent months as a result of the company’s continued strong financial performance. This has made the stock look expensive compared to its own history, although it still appears attractively priced relative to its peers.

Figure 23: Livongo EV/S ratio

(Source: Created by author using data from company report and Yahoo Finance)

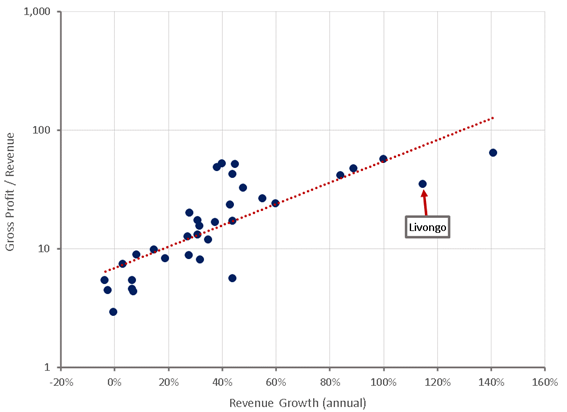

Figure 24: Comparable Company Gross Profit / Revenue Ratio

(Source: Created by author using data from company reports and Yahoo Finance)

Based on a discounted cash flow analysis I estimate the intrinsic value of Livongo to be approximately $130 USD per share. The stock offers significant upside if the company can continue to build a large user base and expand into a range of adjacent verticals, making Livongo the consumer-facing digital platform for health and well-being. There are significant risks though, including whether Livongo’s services will be sufficiently sticky in the long term and how the company will fare against increasing competition, particularly if large tech companies become serious about the space. Clinical data from a number of Livongo’s competitors also indicates that they have superior solutions, which may translate into lost market share in the future. In addition to growing client / member numbers, investors should look for clinical data supporting improved efficacy and improving user retention numbers.